In this guide, I compare Recotap vs. Demandbase on features, pricing and ABM fit so marketing and sales teams can quickly see which platform lines up with their ABM motion.

I also cover how ZenABM can serve as a better alternative or a complementary layer, thanks to its unique feature set.

Recotap presents itself as a LinkedIn-first ABM platform for B2B teams that want to identify, engage and convert high-value accounts with more precision.

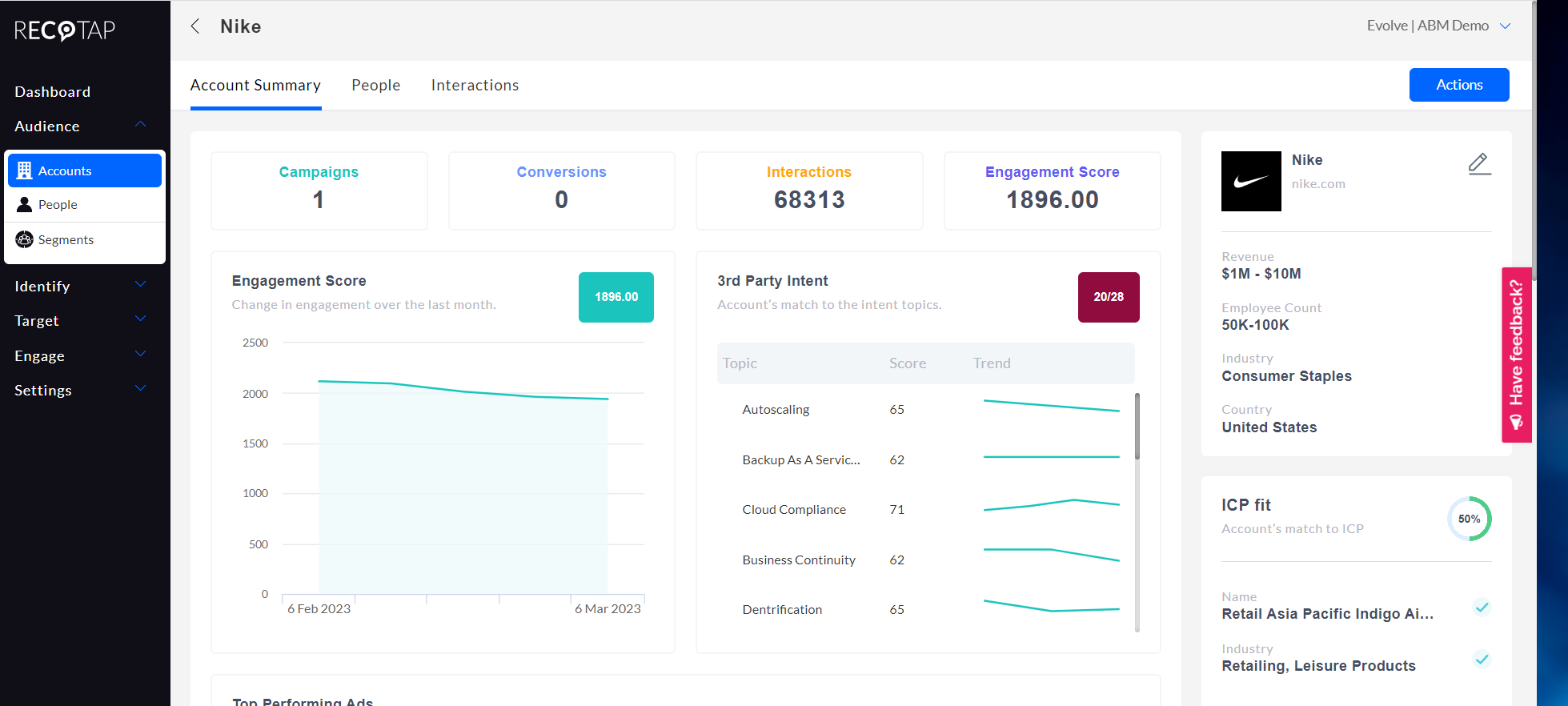

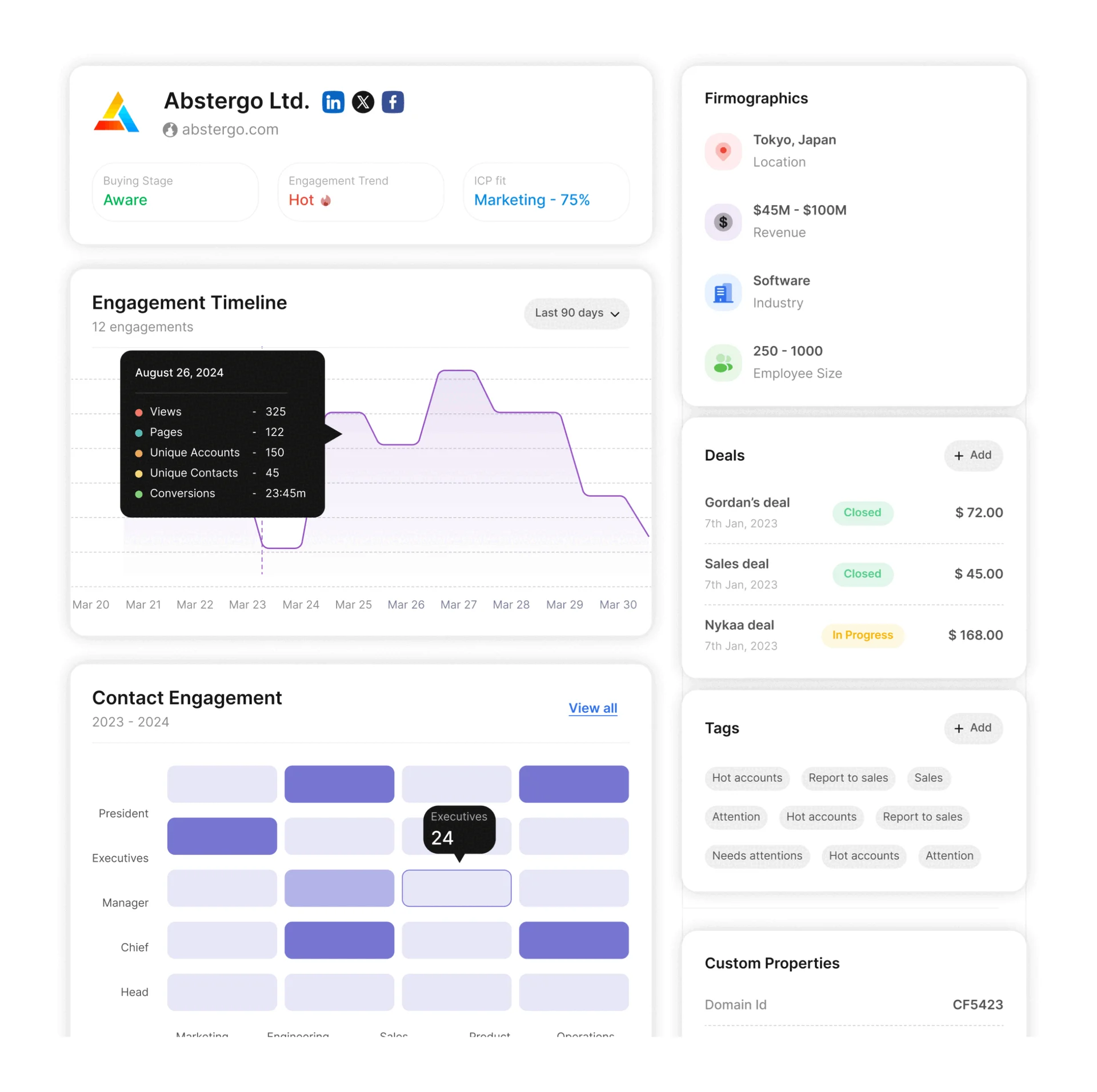

Recotap is an all-in-one ABM system that covers data, advertising, web experience and analytics.

Recotap pulls data from your CRM, marketing automation, website and third-party intent providers into a single account view.

In practice, it joins signals like site visits, ad clicks, external intent (Bombora, G2, TrustRadius) and CRM data so you can segment and score accounts by fit and activity.

The aim is to understand where each account is in its buying journey and point campaigns at those that match timing and fit.

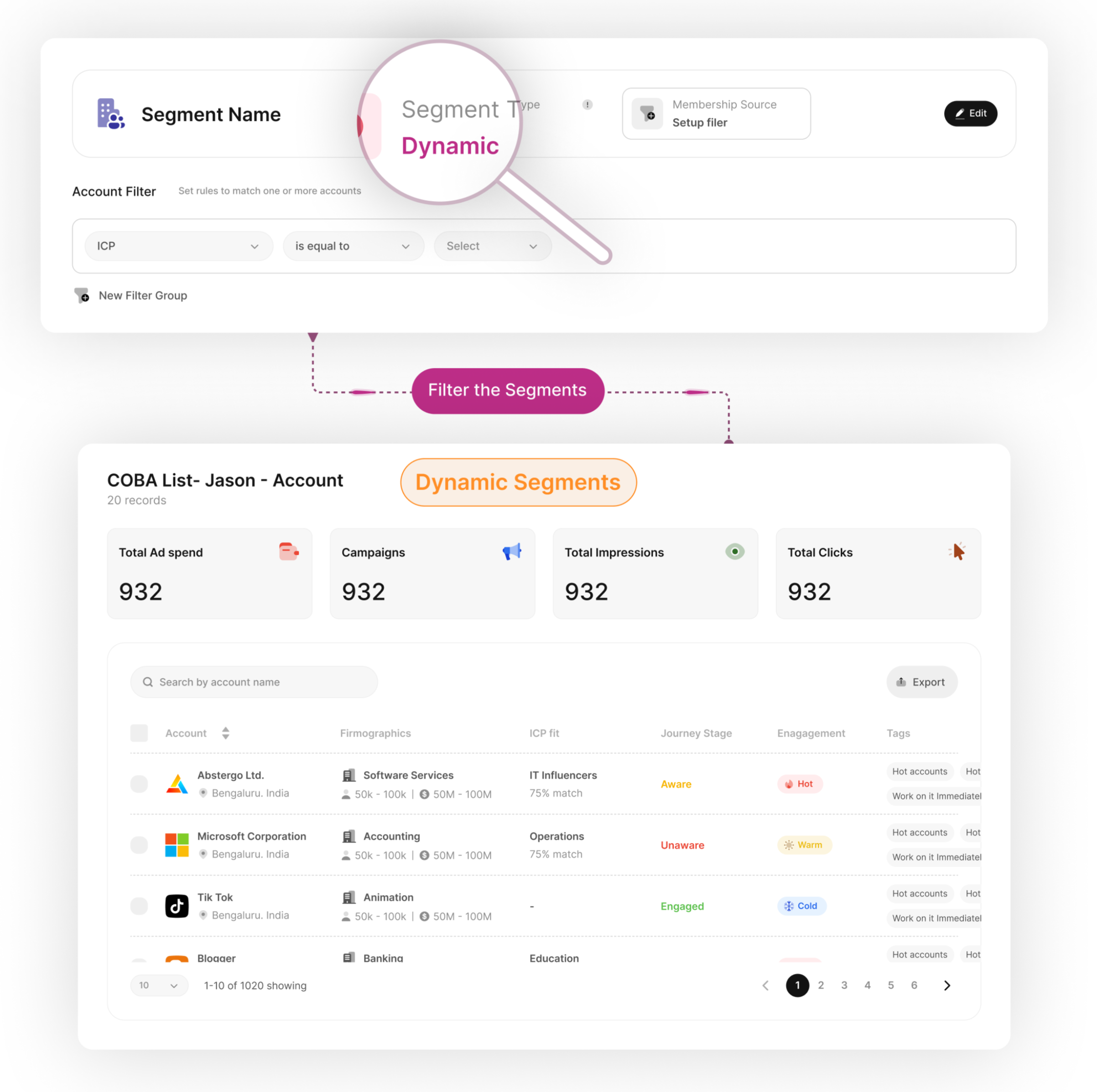

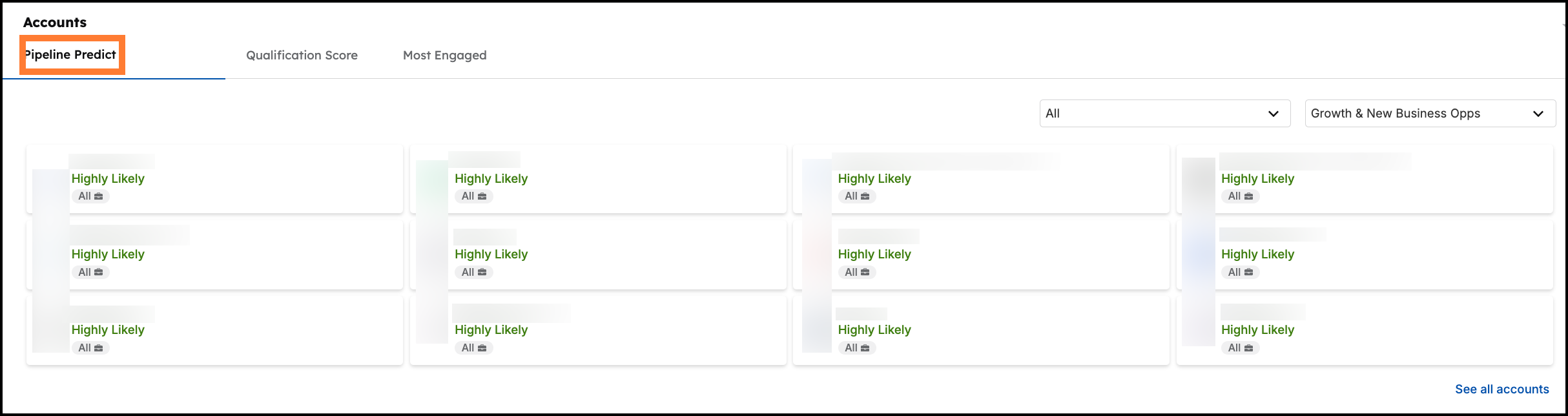

Recotap leans on dynamic segments and AI scoring. You define segments using firmographics, engagement, ICP fit and intent level, and the system keeps these lists refreshed automatically as data changes.

This cuts down manual work on target account lists. Recotap’s AI can also estimate journey stages so you know if an account is early research, actively engaged or close to sales.

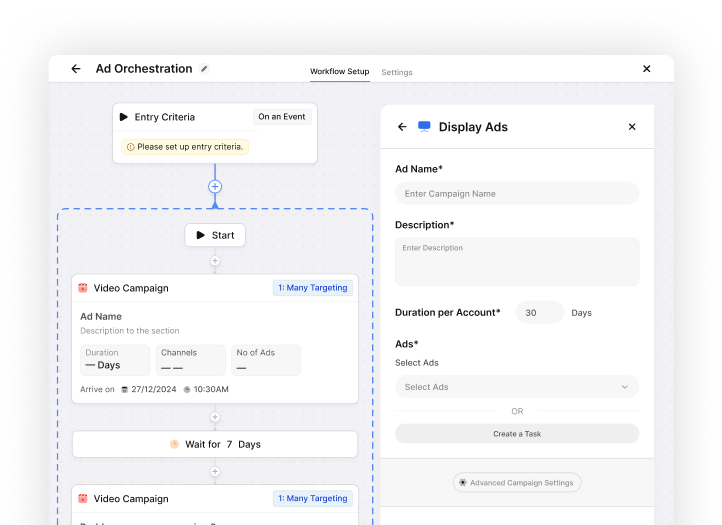

As an official LinkedIn Marketing Partner, Recotap is built for advanced LinkedIn Ads management.

It supports account based LinkedIn campaigns and helps marketers roll out highly tailored LinkedIn ads for dozens or hundreds of accounts at once.

Recotap extends personalization to your website. You can set up 1:1 landing page experiences for target accounts without heavy engineering, putting it closer to web personalization modules in tools like Terminus or Demandbase.

Recotap integrates with major CRM and marketing automation platforms so sales and marketing can work from shared data.

Salesforce and HubSpot CRM are supported with bi-directional sync for accounts, contacts and deals, alongside Marketo and Pardot for marketing automation.

It also connects to sales tools like Outreach and Salesloft, plus Slack and Microsoft Teams, so BDRs get alerts when a target account crosses a threshold.

Recotap includes AI-powered analytics and revenue attribution dashboards.

Its Revenue Impact view links campaigns to pipeline and revenue so you can see which programs drive closed deals and how account journeys progress from first touch to conversion.

Recotap automates repetitive ABM tasks so lean teams can still run complex programs.

It tracks intent spikes, refreshes segments and triggers outreach when an account hits a hot score. One G2 reviewer notes that Recotap’s UX is built to simplify ABM without sacrificing outcomes.

Recotap’s main differentiator is how it merges and interprets intent data to run smarter ABM campaigns.

Its ABM Signal Hub blends first-party engagement data from CRM, website and marketing tools with third-party intent from G2, TrustRadius and Bombora, removing data silos and giving a more complete view of each account.

The intent scoring engine aggregates these signals, ranks accounts by readiness and pushes hot ones into campaigns or sales queues. Because sync is real-time, Recotap can trigger LinkedIn ad sequences as soon as an account shows buying behavior.

The upside is precise targeting with less manual monitoring, though the flexibility introduces some complexity. Reviewers say that once configured, intent orchestration feels close to what you get in tools like 6sense or Demandbase.

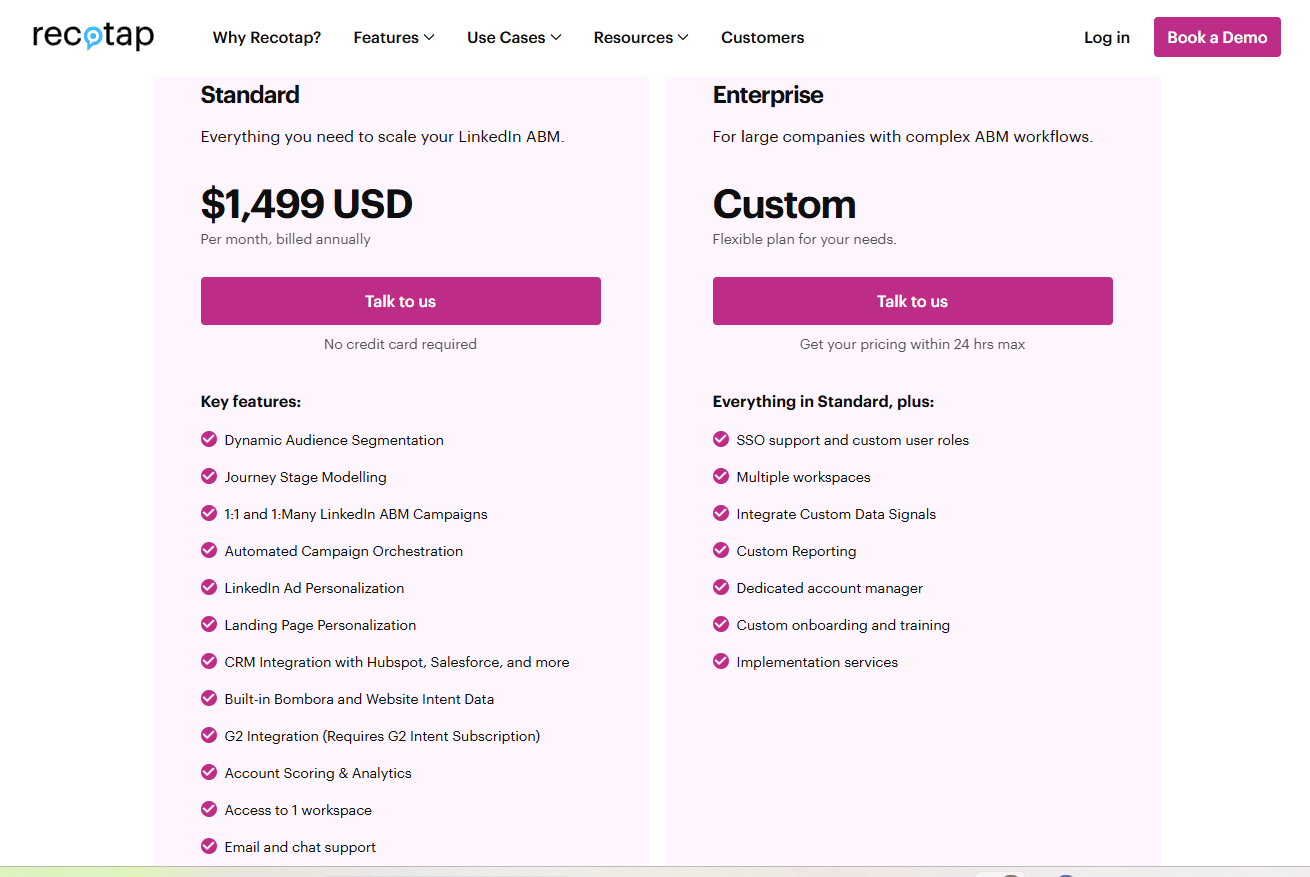

Recotap publishes pricing on its site, which makes budgeting easier.

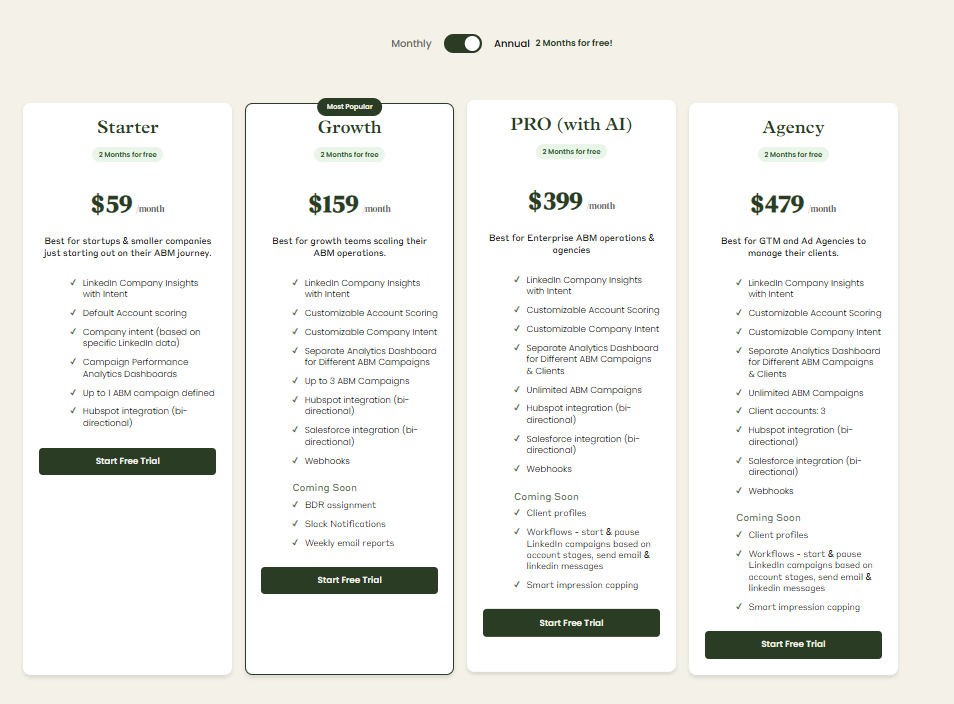

Given that Recotap’s entry plan already comes in above $10K per year, ZenABM stands out as a more budget-friendly option, starting at ~$59/month for the Starter plan, with the top tier still under $6K per year.

ZenABM still covers core LinkedIn ABM needs such as account-level ad engagement tracking, account scoring, ABM stage tracking, routing hot accounts to BDRs, bi-directional CRM sync, custom webhooks, qualitative company intent and plug and play ROI dashboards.

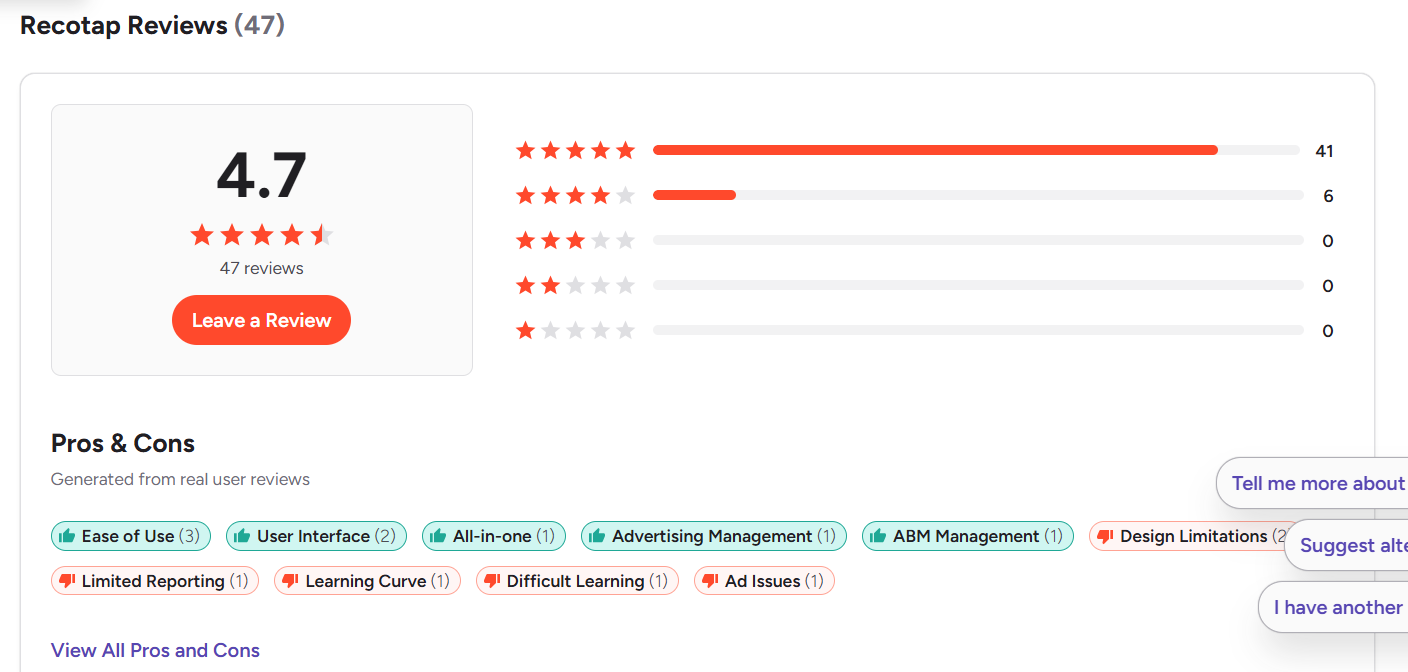

Recotap holds a 4.7 out of 5 rating on G2 from 47 reviews.

Most reviewers are based in Asia, which hints that Recotap’s GTM motion is currently APAC heavy.

Users often praise:

Common issues include:

TrustRadius and other review platforms are still relatively quiet on Recotap.

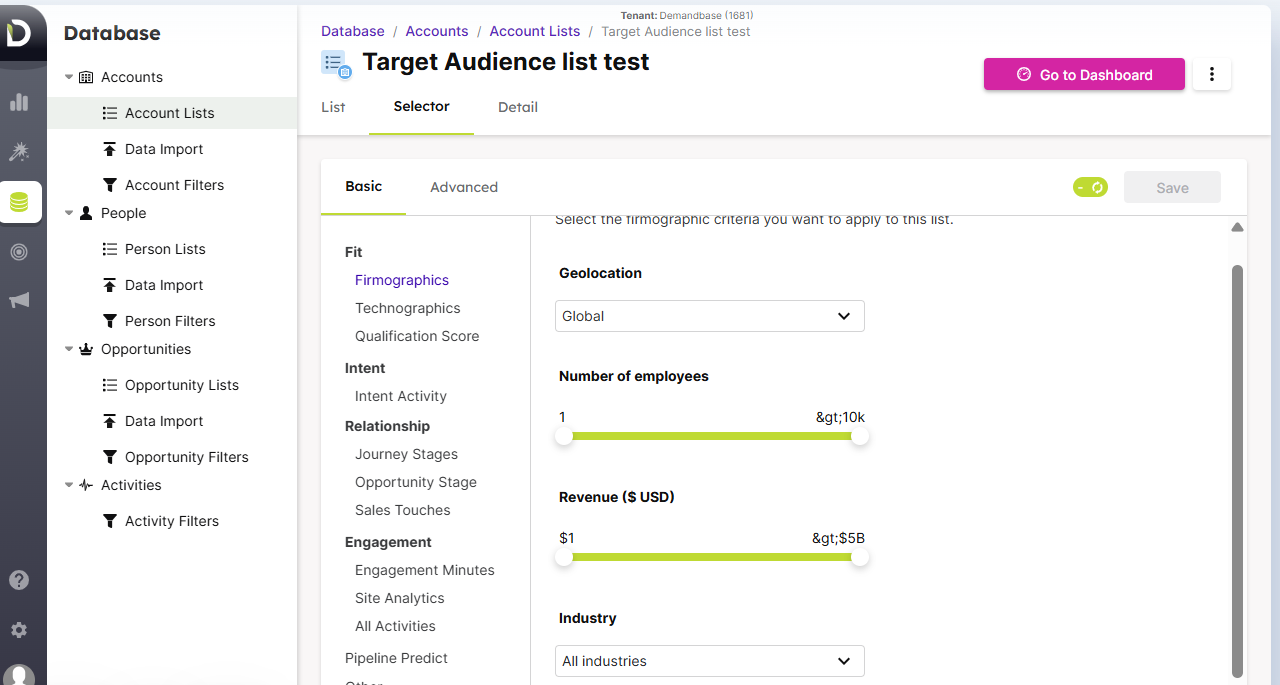

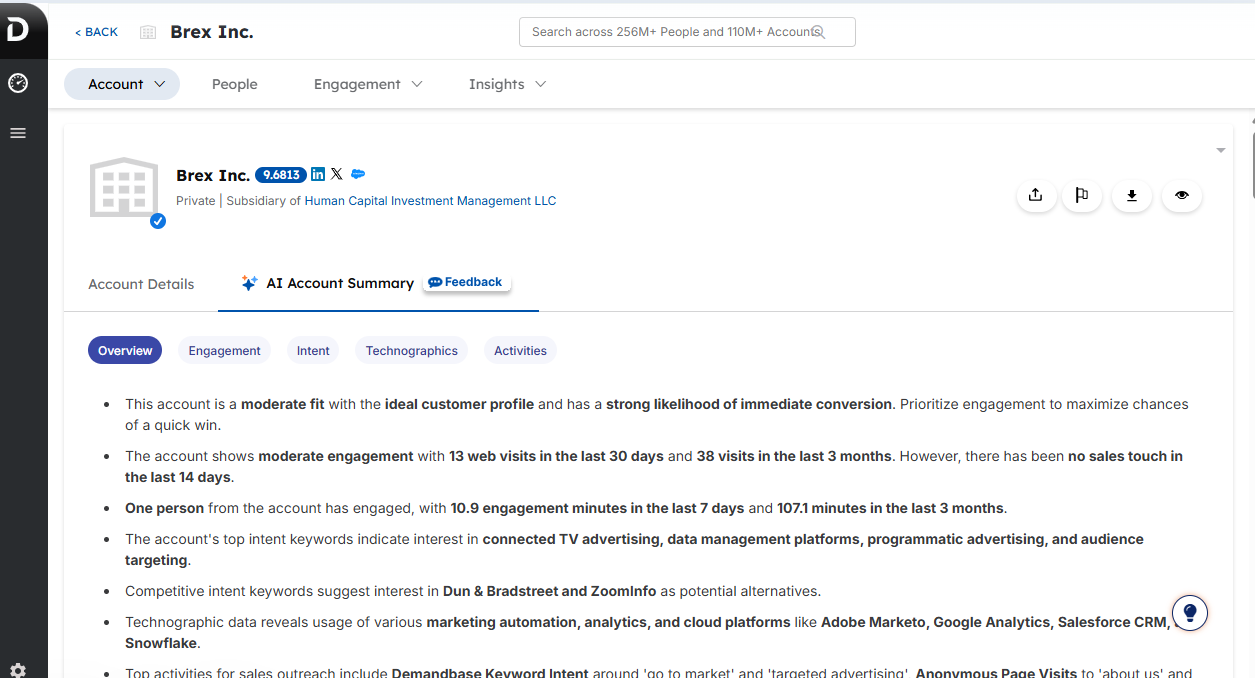

Demandbase functions as a comprehensive ABM platform that covers everything from building target account lists to running multi-channel advertising and customizing on-site experiences.

Its broad toolkit lets teams replace several point tools with one system, which can reduce operational friction.

Demandbase also unifies account and contact data to strengthen sales intelligence, enrichment and outbound strategy so ABM execution becomes more coordinated.

Key Demandbase capabilities explained:

Demandbase helps you create and tune target account lists by combining first-party and third-party data, with AI suggestions that factor in firmographics, technographics and intent signals.

This helps larger organizations quickly identify which accounts deserve priority.

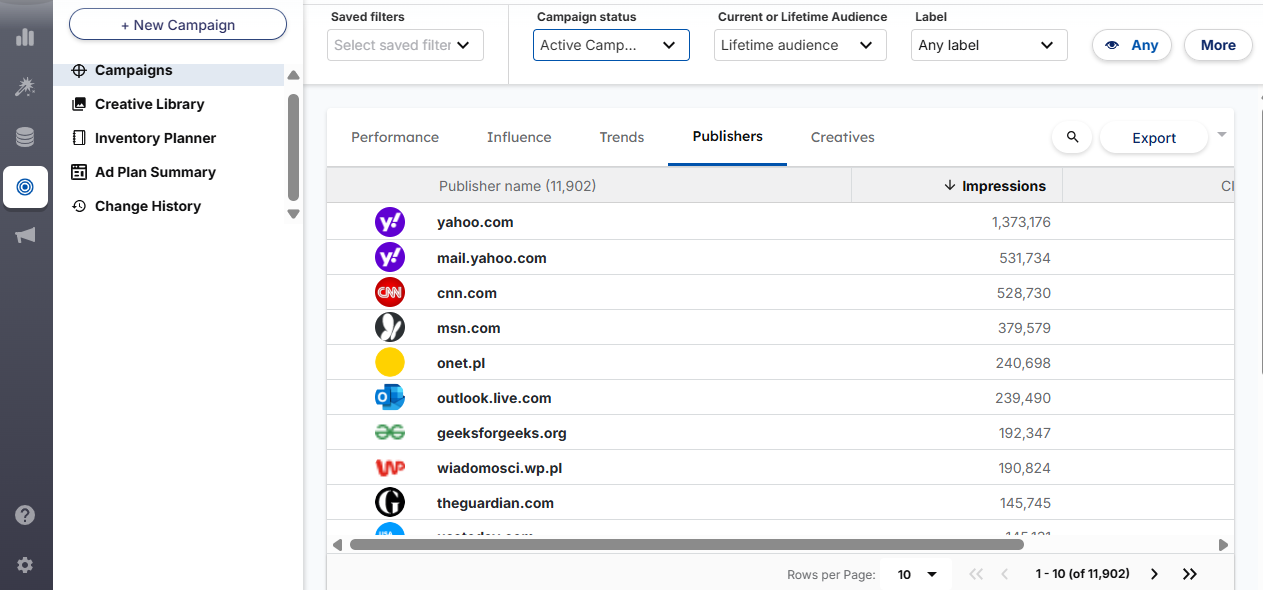

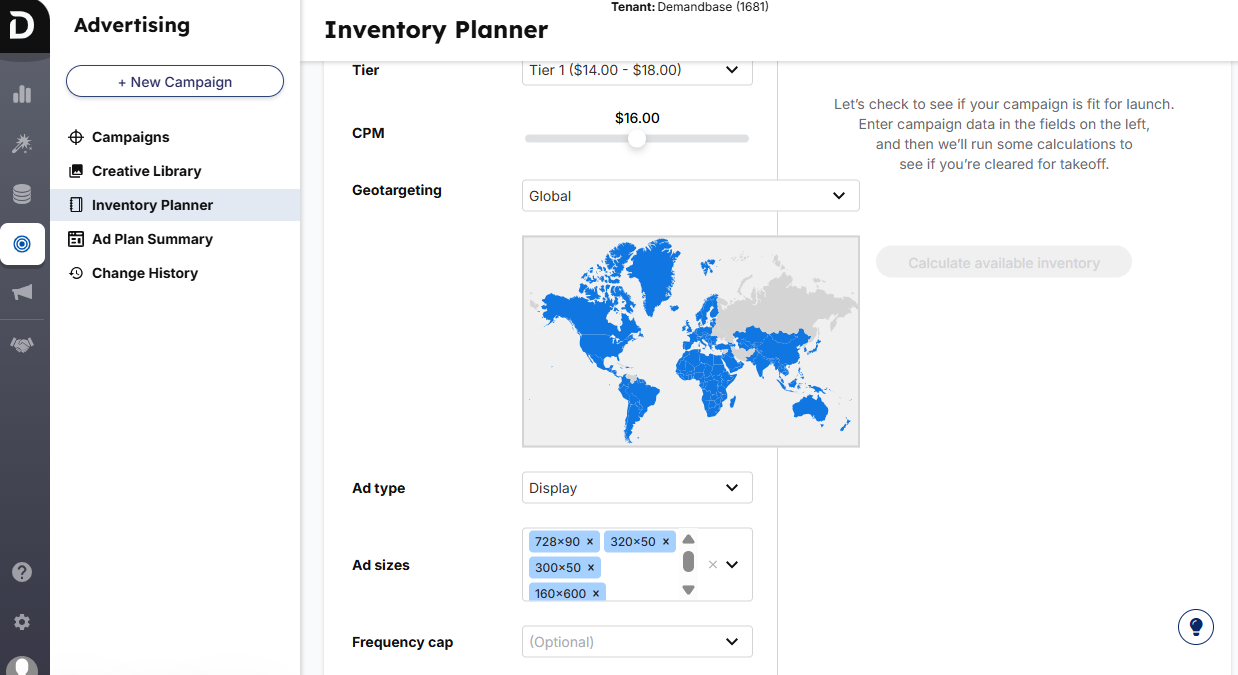

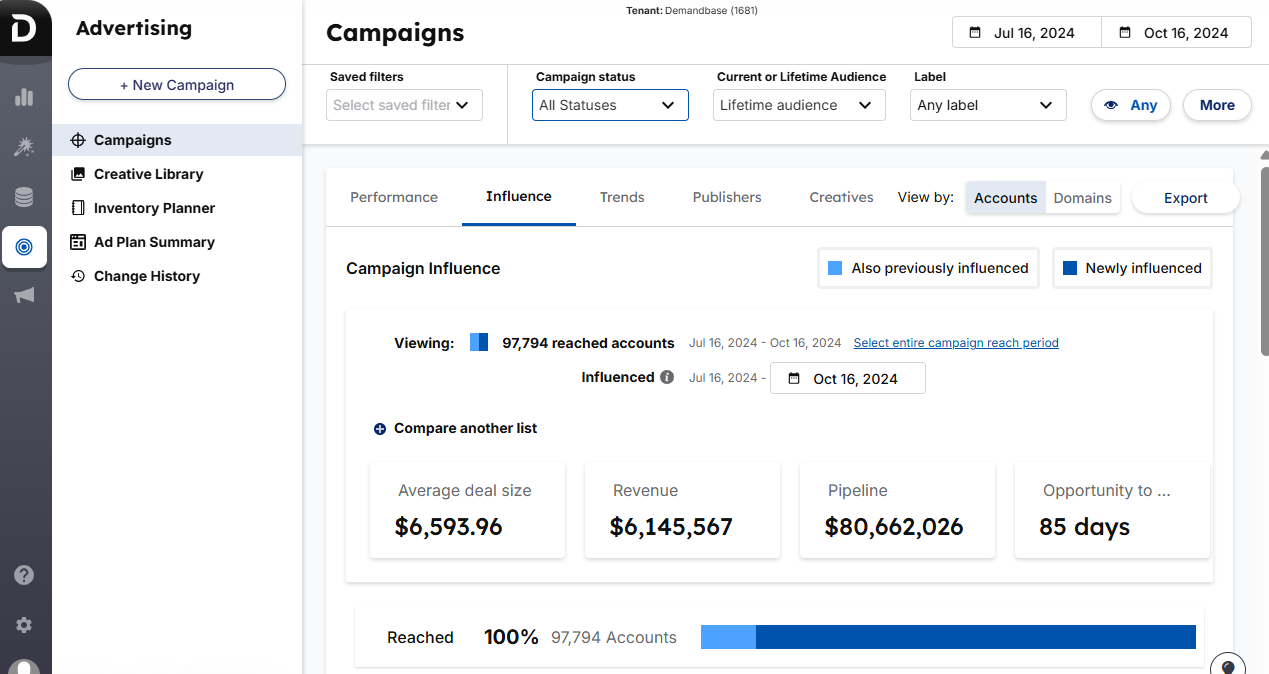

Demandbase includes a native programmatic engine so you can run display, retargeting, native and Connected TV campaigns from one place. The DSP uses intent data to reach high value audiences more precisely.

It also connects to major social networks. You can manage LinkedIn, Facebook, Twitter and YouTube within Demandbase, set account level frequency caps and use AI to optimize budgets.

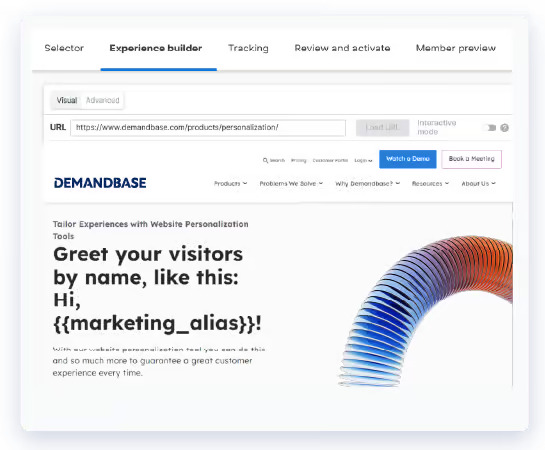

Demandbase supports personalized site experiences for target accounts.

You can create account specific pages or dynamic modules such as greetings or offers tied to industry or funnel stage.

Demandbase pulls in third-party intent across more than 62,500 B2B topics and blends it with first-party engagement.

That lets Demandbase surface target accounts that are “surging” on relevant themes via providers like Bombora, along with how those accounts interact with your assets.

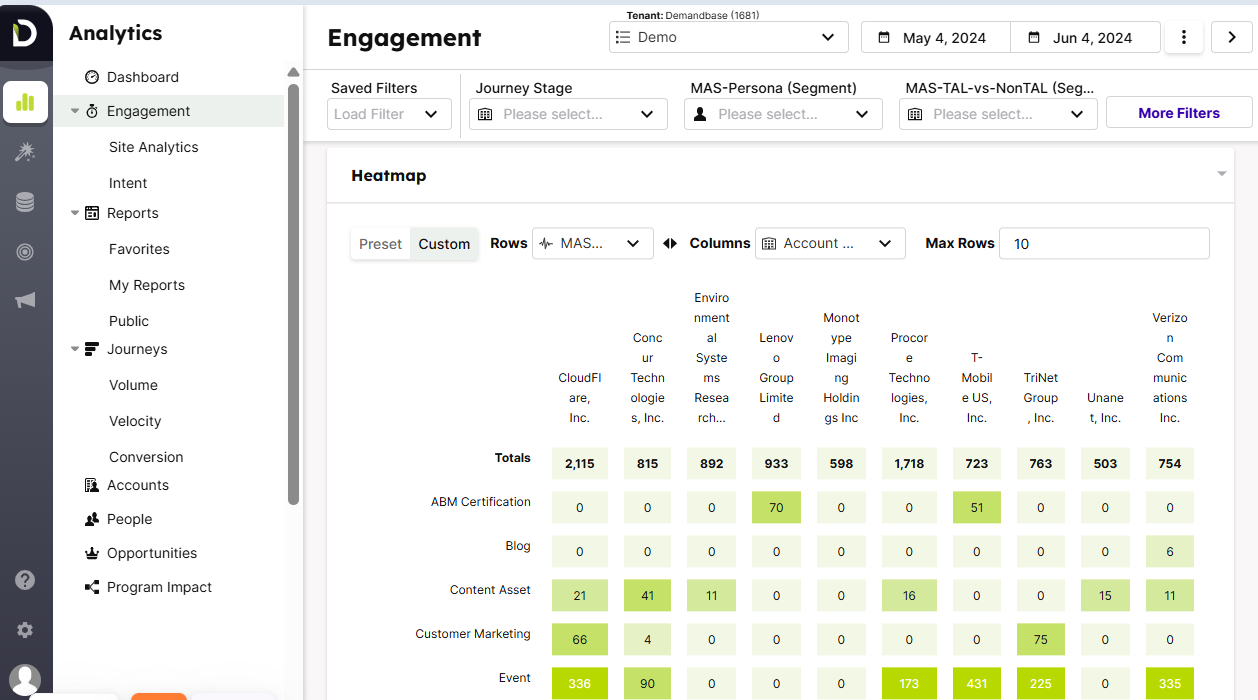

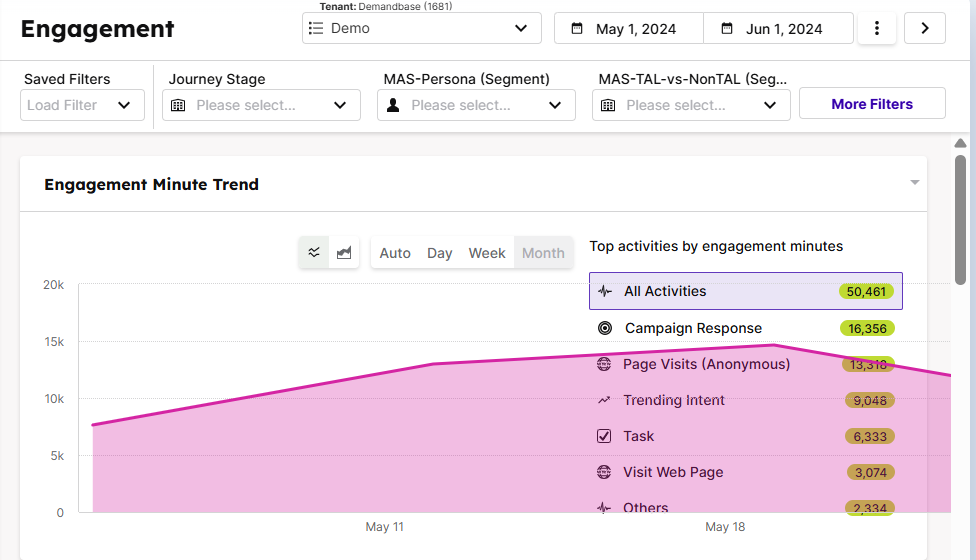

You also get heatmaps and engagement scores across channels, plus predictive analytics to highlight likely in market accounts and guide sales and marketing focus.

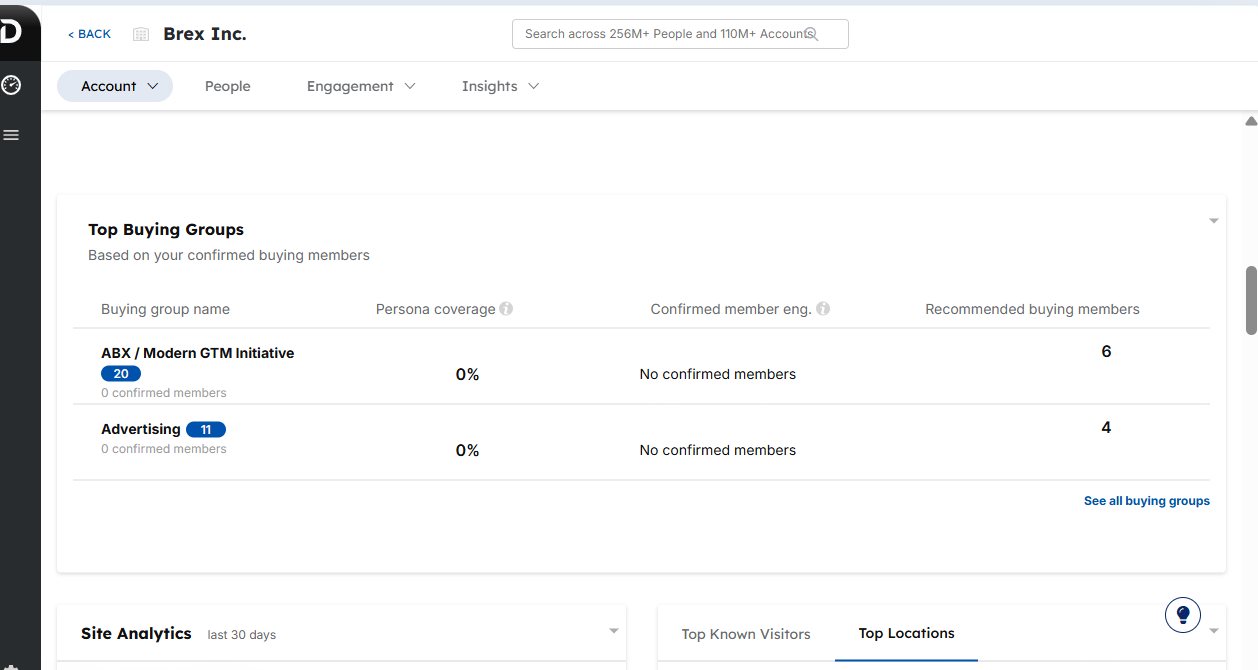

The platform builds buying committees by finding and targeting decision makers at each account so you can focus ads and sales motions on the right roles.

Demandbase provides robust reporting to measure account engagement, campaign influence on pipeline and revenue attribution across the full journey.

AI models estimate likely pipeline outcomes and highlight where reps should focus to improve win probability.

Remember: someone still needs to own and maintain these dashboards for them to keep reflecting reality.

Demandbase integrates with leading CRMs like Salesforce, marketing automation platforms (MAPs) and sales tools so account insights flow into sales workflows, for example via a Salesforce component that shows engagement. It also connects with sales engagement tools like Outreach and Salesloft.

This alignment helps marketing and sales operate from a shared account view.

For the full catalog, see the Demandbase official docs.

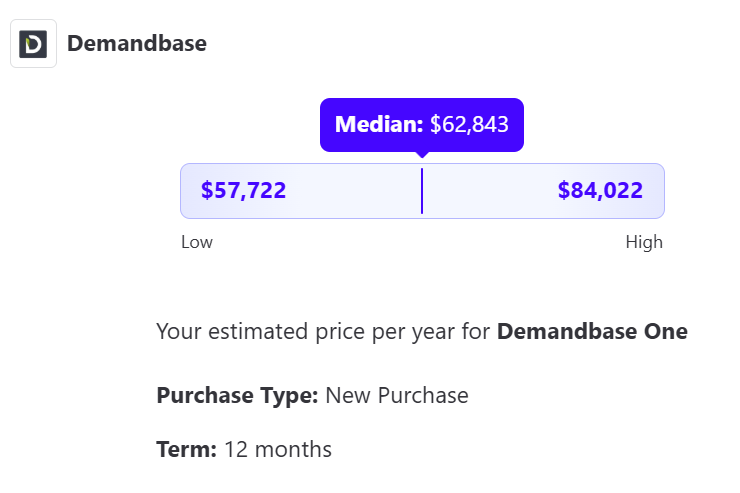

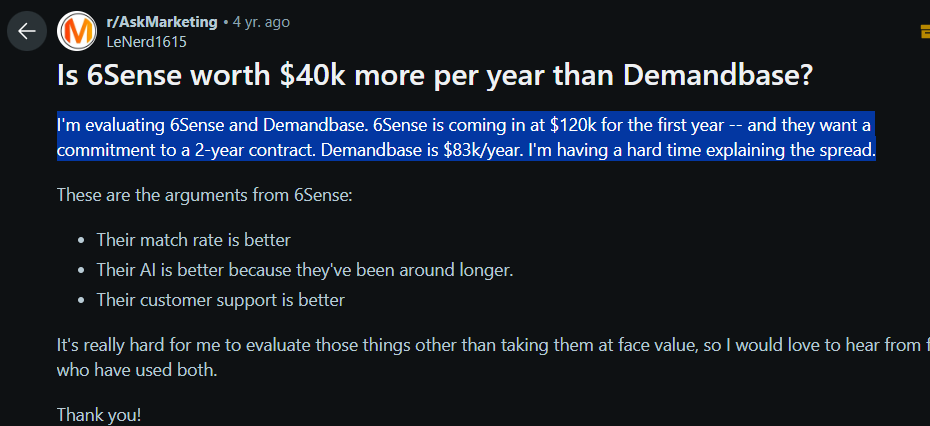

Demandbase does not publish list prices and usually offers custom enterprise packages after a sales conversation.

Most deals combine a platform fee with per-seat pricing, rising with team size and usage such as engaged account volume or activity levels.

According to industry references:

When reviewing quotes, external benchmarks help you keep pricing realistic and avoid overbuying.

Optional add-ons, such as extra intent data or sales intelligence databases, can increase the bill.

Because of its breadth, many small businesses find Demandbase more than they need and risk paying for modules that stay idle.

In short, Demandbase suits teams with sizable ABM budgets and a mature program in place.

Users have these complaints against Demandbase One on G2:

The key differences between Recotap and Demandbase are summarized here.

| Dimension | Recotap | Demandbase | Where ZenABM Fits |

|---|---|---|---|

| Primary Focus | LinkedIn first ABM execution with web personalization and analytics | Full-scale ABM platform with DSP, multi-channel ads and site personalization | LinkedIn first-party intent, ABM stages, account scoring and revenue analytics |

| Core Use Case | Identify and engage high-value accounts via LinkedIn ads and tailored landing pages | Replace several point tools with one ABM suite across ads, web and intelligence | See which companies engage with LinkedIn ads and tie that to pipeline and CRM workflows |

| Channels Covered | LinkedIn Ads, website personalization, CRM and MAP connected programs | Programmatic display, retargeting, CTV, LinkedIn, other social and web | LinkedIn Ads only, with data pushed into CRM and other tools via syncs and webhooks |

| Intent Data | First-party engagement plus third-party intent from Bombora, G2 and TrustRadius | Large third-party topic graph blended with first-party engagement and AI models | First-party qualitative intent from actual LinkedIn ad engagement at the company and job title level |

| Segmentation & Scoring | Dynamic segments, AI scoring and journey stages for target accounts | AI-powered account prioritization and predictive scores for in-market accounts | Configurable engagement scores and ABM stages that sync directly to CRM properties |

| Website Personalization | 1 to 1 landing page experiences and tailored modules for key accounts | Rich web personalization across pages and modules for industries and stages | No native web personalization, focuses on LinkedIn and CRM based views |

| Integrations | Salesforce, HubSpot, Marketo, Pardot, Outreach, Salesloft, Slack, Microsoft Teams | Salesforce, MAPs, sales engagement tools and other GTM systems | Bi-directional HubSpot sync, Salesforce sync on higher tiers, webhooks for other tools |

| Analytics & Attribution | Revenue Impact dashboards linking campaigns to the pipeline and revenue | End-to-end account engagement and pipeline influence reporting | ROAS, pipeline per dollar and stage movement for LinkedIn campaigns at the account level |

| Pricing Level | Standard around 1,499 dollars per month, Enterprise via custom quotes | Typically tens of thousands per year, often 40K to 100K or more, depending on scope | Starts at 59 dollars per month, the highest tier is under 6,000 dollars per year |

| Ideal Team Profile | LinkedIn-centric B2B teams that want ABM execution without full suite heft | Mature mid-market and enterprise orgs with complex ABM and large budgets | LinkedIn heavy marketers and agencies wanting lean, focused ABM intelligence |

| Complexity | Moderate setup and learning curve, designed to keep ABM manageable | High complexity, requires dedicated owners and longer onboarding | Lower complexity with fast time to value for LinkedIn-focused programs |

Choose Recotap if:

Choose Demandbase if:

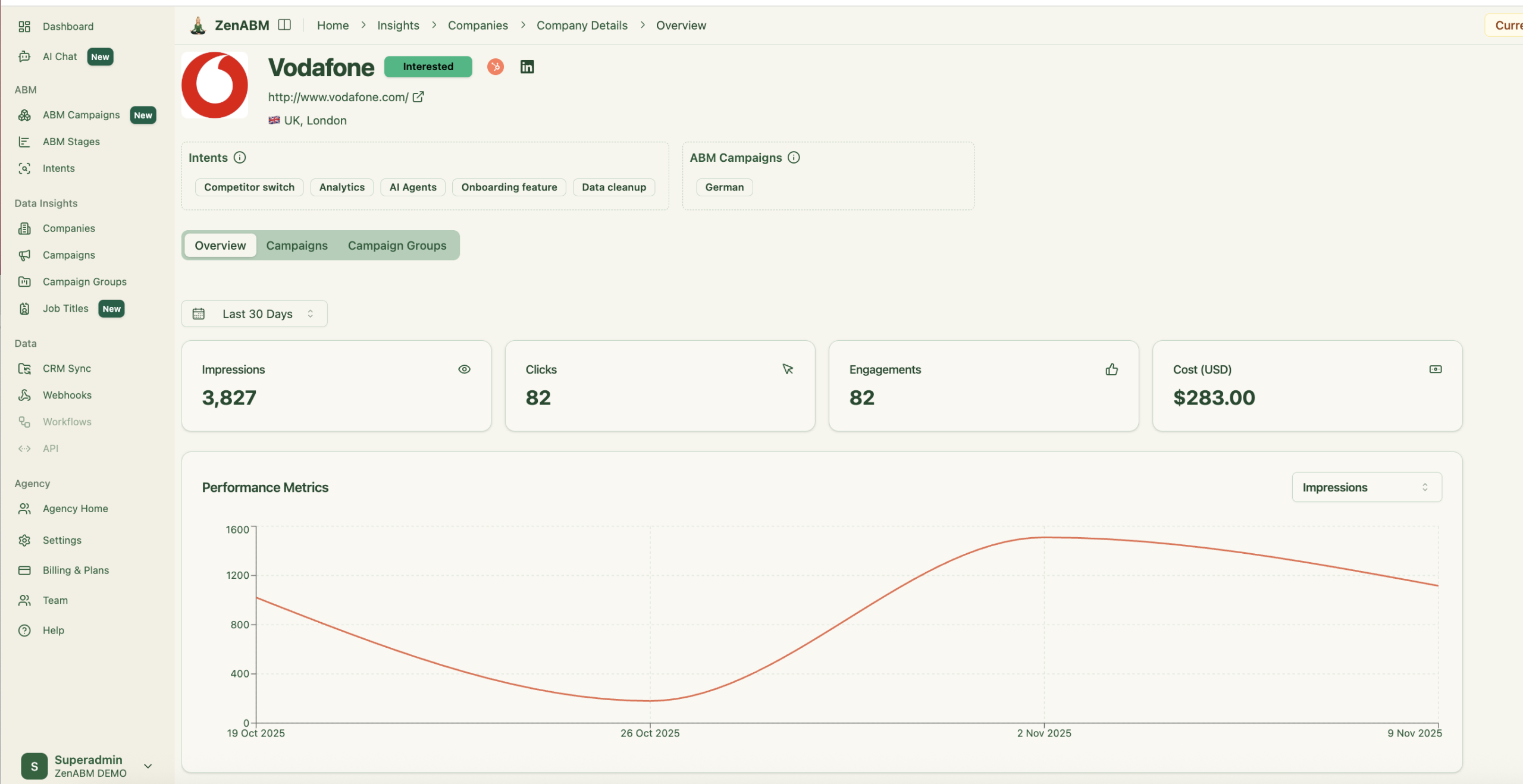

ZenABM is built for teams that rely on LinkedIn as the primary ABM channel and want first-party accuracy, automation, and revenue visibility without the price or complexity of multi-channel suites.

Let’s look at its core features:

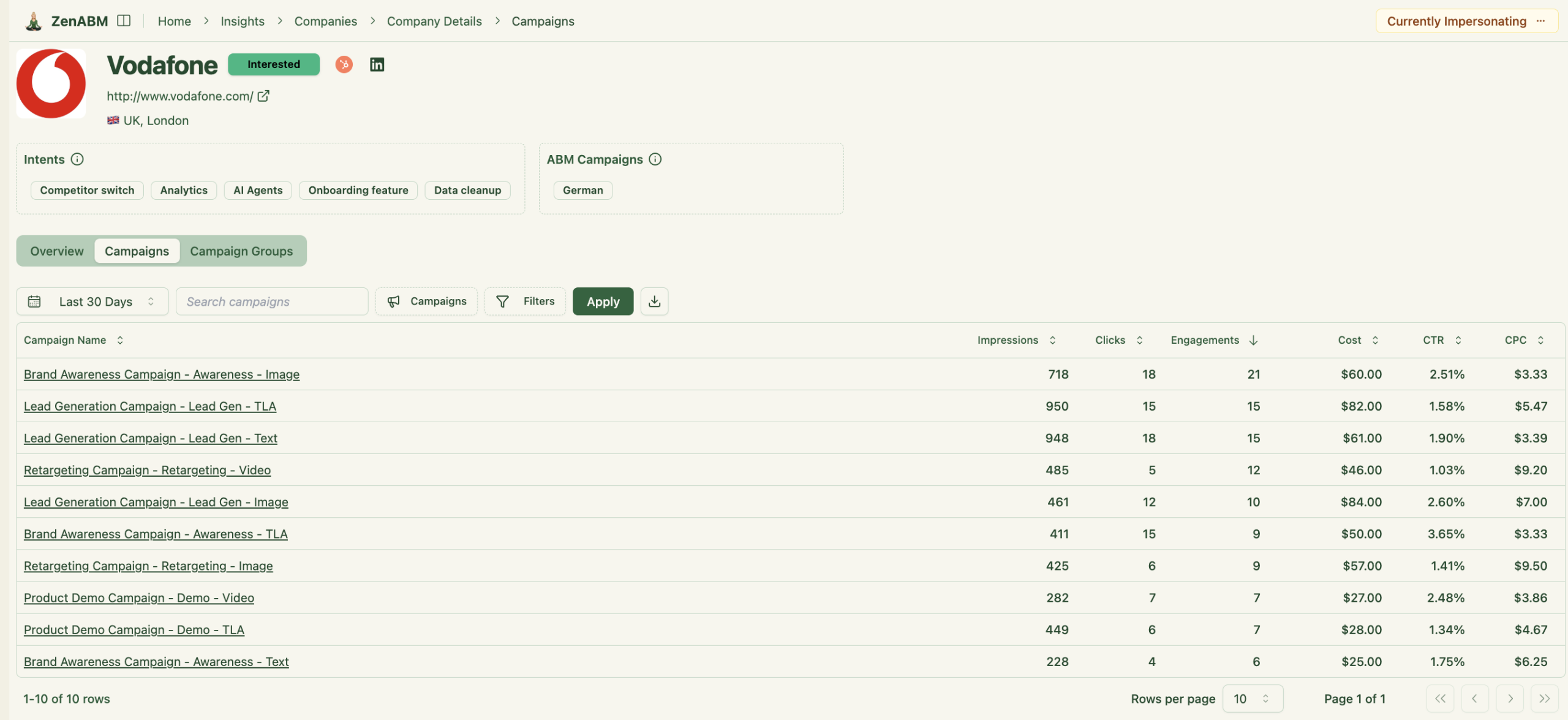

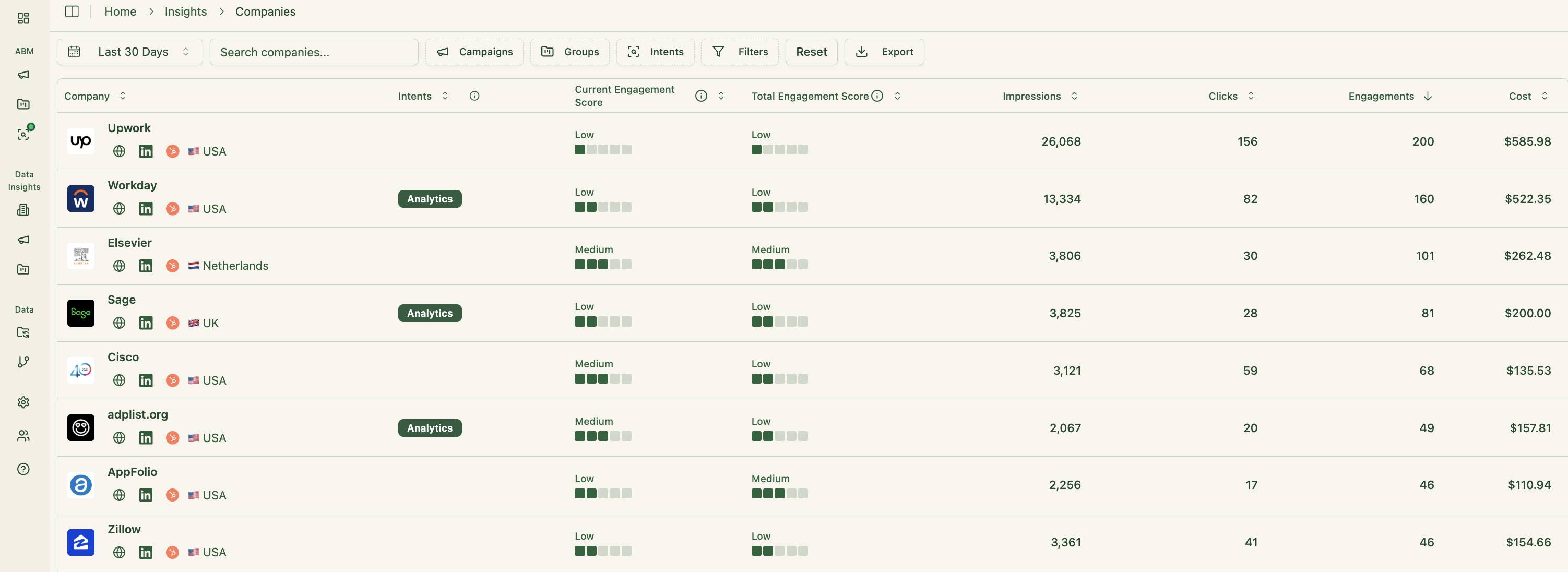

ZenABM connects to the official LinkedIn Ads API and captures account-level data for all campaigns so you can see which companies see, click, and engage with your ads.

Because this is first-party data from LinkedIn’s environment, it is more reliable than IP or cookie-based visitor ID.

A Syft study puts IP-based identification at around 42 percent accuracy.

ZenABM treats LinkedIn ad engagement itself as first-party intent. When several people in one company keep engaging with your ads, that is a strong buying signal without rented intent feeds.

ZenABM updates engagement scores as accounts interact with your ads across campaigns, so you can see who is heating up over short or long windows and let marketing and sales prioritize accounts that show real intent.

ZenABM also shows the full touchpoint timeline for each company:

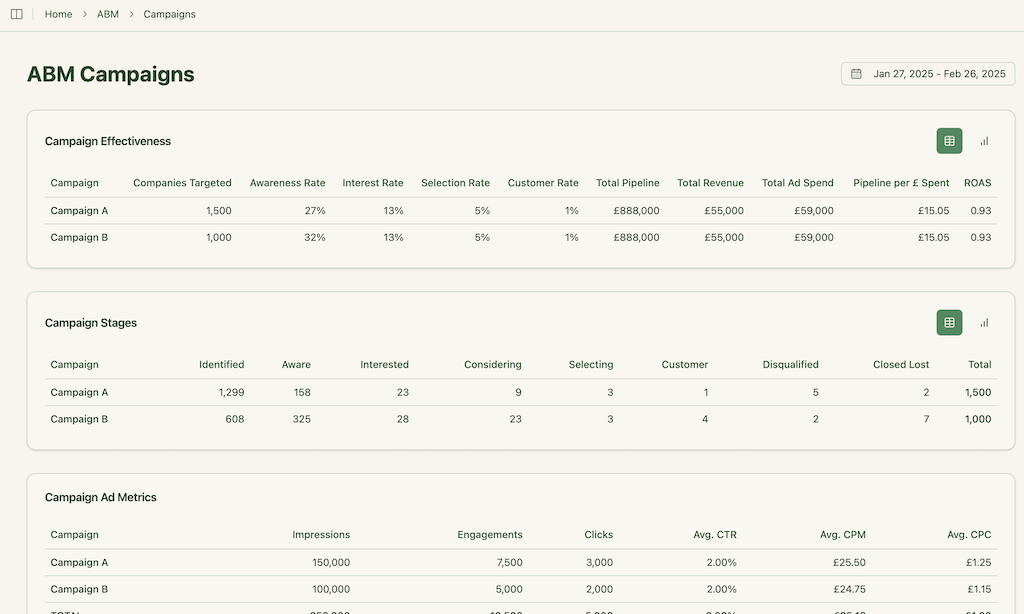

ZenABM lets you define stages such as Identified, Aware, Engaged, Interested, and Opportunity and automatically places accounts in the right stage using scores and CRM data.

You control thresholds, and ZenABM tracks movement over time.

This gives you funnel visibility similar to larger suites, but powered by LinkedIn data.

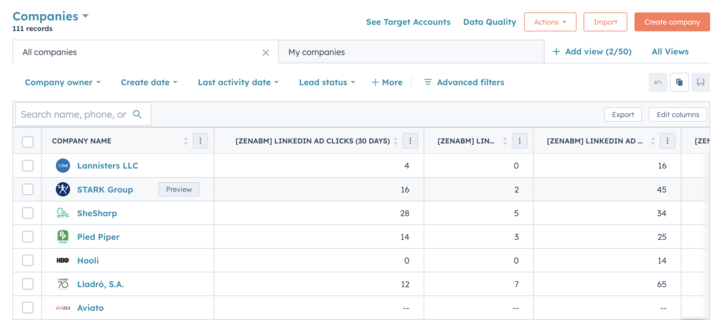

ZenABM integrates bi-directionally with CRMs like HubSpot and adds Salesforce sync on higher tiers.

LinkedIn engagement data flows into the CRM as company-level properties:

Once an account crosses your score threshold, ZenABM updates the stage to Interested and automatically assigns a BDR.

ZenABM lets you derive intent topics from LinkedIn campaigns by tagging campaigns by feature, use case, or offer.

ZenABM then shows which accounts engage with which themes.

This is clean, first-party intent from owned interactions.

You can push these topics into your CRM, so sales and marketing can tailor outreach to what each company has actually explored.

ZenABM ships with dashboards that connect LinkedIn ads to account engagement, stage movement, and revenue.

ZenABM shows which job titles engage with your creatives and gives dwell time and video funnel analytics.

ZenABM provides its AI chatbot called Zena that basically answers all you want from ZenABM in natural language.

You can ask Zena open-ended questions like you would a smart analyst and get company-level answers about:

Under the hood, Zena combines OpenAI with a library of carefully designed prompts and endpoints to join ad engagement, spend and CRM deals so it can explain which campaigns drove pipeline, which accounts turned into opportunities, which formats perform best and which companies are high intent but untouched by sales.

Instead of exporting spreadsheets and stitching pivot tables, you get plain language insights, ready to drop into strategy reviews, weekly sales standups or executive updates.

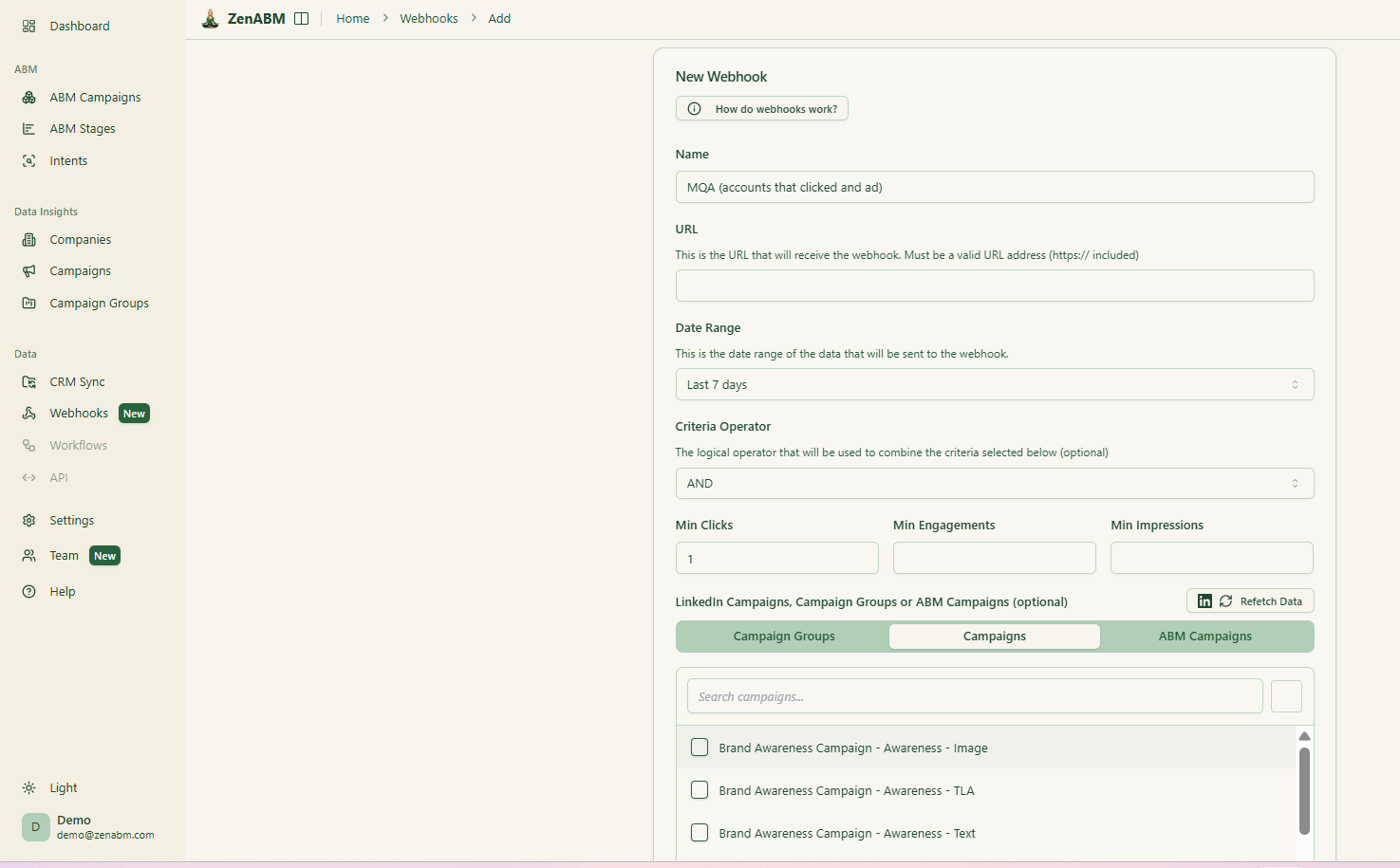

ZenABM’s custom webhooks let you push events into your stack, for example, Slack alerts, enrichment flows, or other ops automations.

Most tools treat each LinkedIn campaign separately. ZenABM lets you group several into one ABM campaign object so you can see performance across regions, personas, or creative clusters.

Instead of juggling fragmented reports in Campaign Manager, you see spend, pipeline, account movement, and ROAS for the entire initiative.

For agencies, ZenABM offers a multi-client workspace.

You can manage multiple ad accounts and clients in one environment, each with its own ABM strategy, dashboards, and reporting, instead of constantly switching accounts in Campaign Manager.

Plans start at $59 per month for Starter, $159 for Growth, $399 for Pro (with AI), and $479 for Agency.

The agency plan still stays under $6,000 per year.

All tiers include core LinkedIn ABM features. Higher tiers mostly increase limits and add Salesforce sync.

Plans are available monthly or annually, and every plan includes a 37-day free trial.

Recotap is aimed at B2B teams that lean hard on LinkedIn and want a practical way to unify data, orchestrate LinkedIn campaigns, personalize key pages and see revenue impact without buying a huge suite. It gives you dynamic segments, journey staging, third-party intent and an execution layer that feels approachable.

Demandbase is what you pick when you want a single system to cover account selection, intent, multi-channel advertising, web personalization and deep analytics across a large account universe. The trade is obvious: more power and breadth, at the cost of steeper pricing and complexity that only makes sense if your ABM program is already quite mature.

If your reality is that most real engagement happens on LinkedIn and gets worked in the CRM, a third option is often smarter. ZenABM focuses on first-party LinkedIn intent, ABM stages, account scoring, CRM sync and revenue dashboards at a fraction of enterprise pricing. It can either become the primary ABM brain for LinkedIn first teams, or sit alongside Recotap or Demandbase as the clean, company-level LinkedIn analytics and intent layer they do not handle as simply.